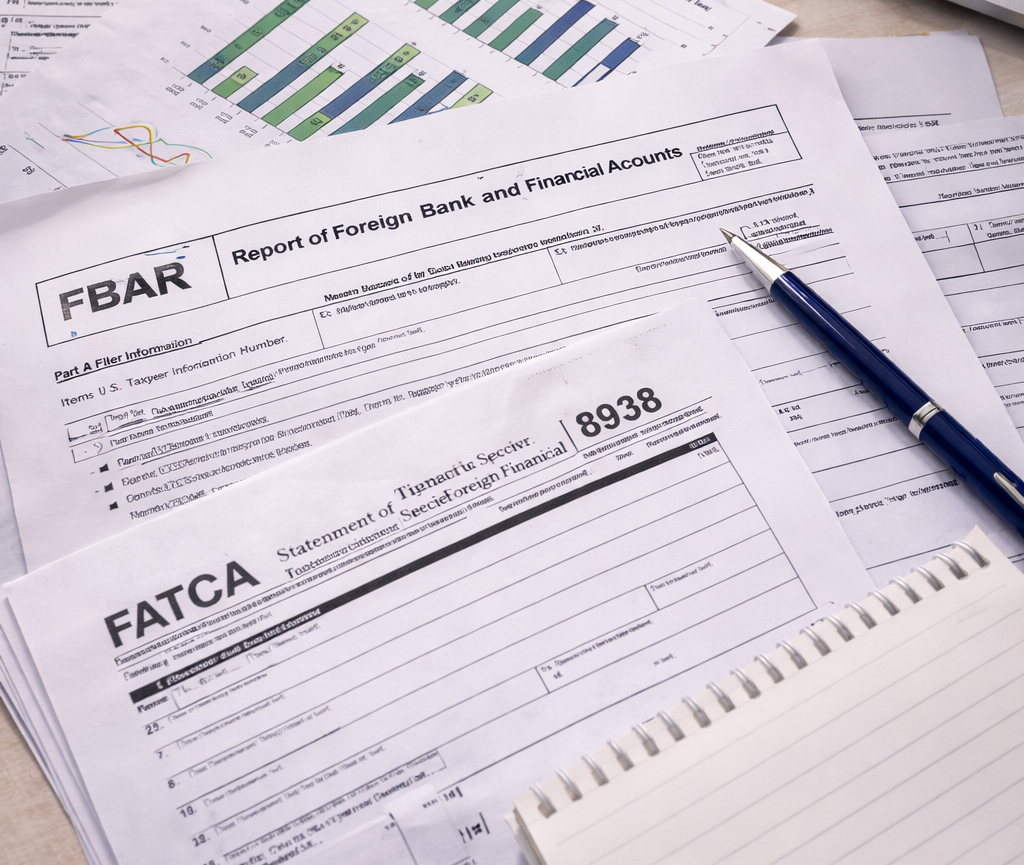

Our FBAR & FATCA Processing services are designed to help individuals and businesses comply with U.S. reporting requirements for foreign financial accounts and assets. These regulations are mandatory for taxpayers who hold or have financial interests in accounts outside the United States. We simplify the entire process by ensuring accurate reporting, timely filing, and full compliance with IRS and FinCEN guidelines, helping you avoid heavy penalties and legal complications.

Accurate Reporting of Foreign Financial Assets

We begin by reviewing your foreign bank accounts, investment accounts, and financial holdings to determine your FBAR and FATCA filing obligations. Our team carefully analyzes account balances, transaction details, and ownership structures to ensure that all reportable accounts are properly disclosed. We prepare and file FBAR (FinCEN Form 114) and FATCA (Form 8938) with complete accuracy, following the latest U.S. regulations and reporting thresholds. Our goal is to make complex international reporting clear, transparent, and error-free.

Key areas covered include:

Ensuring consistency across all IRS submissions

Identification of reportable foreign accounts and assets

Preparation and filing of FBAR and FATCA forms

Review of account balances and reporting thresholds

Coordination with your tax return filing

Compliance, Risk Reduction & Ongoing Support

FBAR and FATCA non-compliance can result in significant penalties, which is why accuracy and timely filing are critical. We help you stay protected by reviewing your past compliance history, identifying gaps, and guiding you on corrective actions if required. Our services also include support with IRS notices, clarification requests, and documentation requirements related to foreign asset reporting. We ensure your reporting remains compliant year after year as your financial situation changes.

Our additional support includes:

- Review of prior-year FBAR and FATCA filings

- Assistance with missed or late filings

- Guidance on penalty risk reduction

- IRS and FinCEN correspondence support

- Ongoing advisory for foreign asset compliance

With our FBAR & FATCA Processing services, you gain confidence that your foreign financial disclosures are handled professionally, securely, and in full compliance with U.S. regulations.